Book Appointment Now

2025 Guide to Company Registration Process and Legal Compliance

Learn everything about the Company Registration Process and Legal Compliance requirements during registration, and annual obligations that every entrepreneur must follow to keep their business running smoothly.

Starting a new business in India can be exciting, but it comes with its own set of legal requirements that must be followed to ensure your company runs smoothly and remains compliant with regulations. Whether you are a budding entrepreneur or planning to take your small business to the next level, understanding the company registration process and legal compliance is crucial to avoid legal hassles in the future.

Company Registration Process

The first step in setting up a business in India is registering your company with the Ministry of Corporate Affairs (MCA). The company registration process typically involves the following steps:

- Choosing the Type of Company: Before registering, decide whether you want to register as a Private Limited Company, Limited Liability Partnership (LLP), One Person Company (OPC), or a Public Limited Company. Most startups in India prefer registering as a Private Limited Company due to its simplicity and limited liability for shareholders.

Please note that to access MCA Services, you need to log in to the MCA portal. If you don’t have an account, you can register at the MCA User Login/Registration page.

Choosing a unique company name is a crucial step in the registration process. For checking the availability of a company or LLP name before applying, you can use the Check Company/LLP Name tool on the MCA portal. Ensure you follow the MCA’s naming guidelines and verify the uniqueness of your proposed company name using the above tools before submission.

Previously, individuals had to apply for a Director Identification Number (DIN) separately via eForm DIR-3 before incorporating a company. However, as per the latest MCA regulations, DIN is now automatically allotted during the company registration process through the SPICe+ (Simplified Proforma for Incorporating a Company Electronically) form. You will find the SPICe+ form under MCA Services tab once you are logged in as a Registered User on MCA Portal. Click Here to Get Registered

ALSO READ: Post Office Monthly Income Scheme (MIS) 2025: Interest Rates, Benefits & How to Invest

For companies that need to appoint additional directors after incorporation, a DIN can be obtained separately by filing eForm DIR-3.

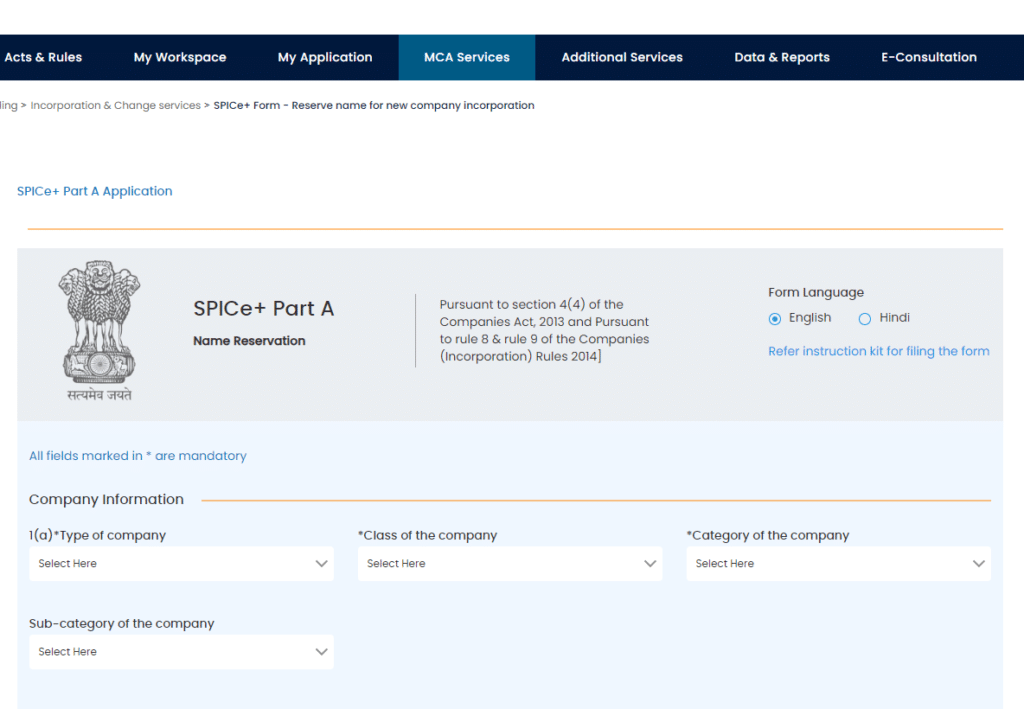

SPICe+ (Part A) – For New Company Incorporation

New companies must apply for name approval directly through SPICe+ (Part A) on the MCA portal. You can propose up to two names in a single application. If the name is rejected, you get one free resubmission within the same application. Once approved, the name is reserved for 20 days (for new companies).

RUN (Reserve Unique Name) – Limited to Name Changes

The RUN service is now only used for changing the name of an existing company or LLP.

Company Name Approval via SPICe+ Part A:

STEP 01: Register on the MCA portal. After Registration log in to your account > Go to MCA Services > Company e-Filing >Incorporation & Change Services > and then SPICe+ Form and then Fill out the SPICe+ Part A form while applying for company incorporation..

STEP 02: Provide details of the proposed directors (up to three directors can apply for DIN through SPICe+)

STEP 03: Submit self-attested identity proof, address proof, and a photograph of each director.

STEP 04: The MCA will process the application, and upon approval, DINs will be allotted to the proposed directors..

Obtain DIN, PAN, TAN via SPICe+ Part B:

This is the primary form for incorporation. Depending on your company’s turnover and the nature of the business, you may need to apply for GST registration. GST is applicable for businesses that have a turnover exceeding ₹40 lakhs (₹20 lakhs for service providers)

- Documents and Filing: You will need to submit necessary documents such as identity proof, address proof, and the company’s memorandum of association (MOA) and articles of association (AOA) that define the company’s structure and rules. During incorporation, the SPICe+ (Part B) form auto-generates an e-MOA and e-AOA for submission to the MCA.

- Certificate of Incorporation: Once all paperwork is submitted and verified, you will receive a Certificate of Incorporation, officially making your company a legal entity.

Legal Compliance Requirements During and After Registration

Once your company is registered, it is essential to comply with various legal requirements to operate within the framework of Indian law. These include:

- Appointment of Auditor: As per Indian law, every company must appoint an auditor within 30 days of registration. This is necessary for the company’s financial audits and proper documentation.

- GST Registration: If your business earns more than ₹40 lakhs (or ₹20 lakhs for service-based businesses), you must register for GST..

In order to register for GST Services visit the following Goods and Services Tax Portal and select New Registration > Submit the form

- Filing of INC-20A (Commencement of Business): This is a declaration that the company has begun its business activities. This document must be filed within 180 days of the company’s incorporation.

Go to the Ministry of Corporate Affairs (MCA) website

Log in to the MCA portal > Select MCA services and then E-Filing

Select Company Forms Download > Form INC-20A (Declaration of commencement of business)

Fill out the form with the required information

Attach the necessary documents

Digitally sign the form with your DSC

Get the form certified by a professional

Upload the form and pay the required fees

Submit the form and wait for an acknowledgment receipt

- Application for Dormant Status under ESI Act: If your company is not yet operational, you may need to apply for dormant status under the Employees’ State Insurance (ESI) Act. This status helps reduce compliance costs until your business is active..

Go to esic.gov.in and click on Employer Login.

Login to ESIC Portal.

A tab opens for selecting whether the company wishes to opt for Dormant Status.

When you opt for No in the first option, the provision of ESI Act 148 is not applicable on the company with immediate effect and the system asks you to mention.

- Company Board Resolutions: A company is required to hold board meetings regularly. Resolutions passed during these meetings must be documented in the board meeting minutes.

- Preparation of Financial Statements: Every company needs to prepare annual financial statements such as the balance sheet, profit and loss statement, and cash flow statement. These statements must comply with accounting standards.

- Director’s and Auditor’s Reports: An annual report needs to be filed with the Registrar of Companies (RoC) that includes the Director’s Report, which details the company’s activities, and the Auditor’s Report on the financial statements.

Annual Compliance After Registration

After your company is officially set up, annual compliance becomes essential to ensure smooth functioning and avoid legal consequences. Some of the key annual compliance requirements include:

- Filing Annual Return (MGT-7): Companies must file an annual return that includes details about shareholders, directors, and the company’s activities.

- Filing Financial Statements (AOC-4): These must be filed within 30 days from the date of the Annual General Meeting (AGM).

- Income Tax Return (ITR): Every company must file an income tax return every year, regardless of whether the company is profitable or not.

- Holding Annual General Meetings (AGMs): AGMs are mandatory for all companies, where shareholders discuss the company’s performance, dividends, and future plans.

- Statutory Registers: Companies must maintain statutory registers like the register of directors, shareholders, and minutes of meetings to comply with the law.

- Compliances under MSME and Other Schemes: New businesses should also keep in mind compliance under various schemes like MSME registration, which can help get easy access to credit and government support.

Whether you’re registering a new company in India or managing an existing one, compliance is key. Keeping up with legal requirements during and after registration will ensure the smooth functioning of your business and avoid penalties. As a new entrepreneur, it’s essential to understand the importance of annual compliance, including filing returns and maintaining statutory records. It’s highly recommended to consult with a legal professional or compliance firm to ensure that your business remains compliant with the law and is poised for long-term success.

If you need assistance with the Company Registration Process and Legal Compliance, we’re here to help. From documentation to approvals, we ensure a smooth and hassle-free experience. Contact us today to get started!